Revolutionize Your Wallet: How to Thrive Financially in Post-Pandemic 2023

Discover how to conquer financial stress in 2023! Learn budgeting, tackle debt, and use tech tools for a secure financial future. #FinanceTips #MoneyManagement

In the shadow of a global pandemic, the economic landscape has been forever altered, leaving many grappling with the resultant financial challenges and uncertainties. The FNBO 2023 Personal Finance Perspectives Survey paints a stark picture: a significant portion of Americans are caught in the throes of financial anxiety, with the specter of debt looming large and the paycheck-to-paycheck cycle proving hard to break. In these times, adapting to financial challenges is not just prudent; it's essential.

Financial anxiety is more than a buzzword; it's a pervasive reality for many. With the cost of living on the rise and economic stability seemingly on the decline, Americans are searching for a foothold. Budgeting is the cornerstone of financial well-being, yet it remains elusive for those who need it most. Living within one's means, a seemingly simple strategy, can be transformative. It's about making informed choices, prioritizing expenses, and, most importantly, planning for the future. Tackling debt is another critical component. It requires discipline, a clear strategy, and sometimes, the courage to seek professional advice.

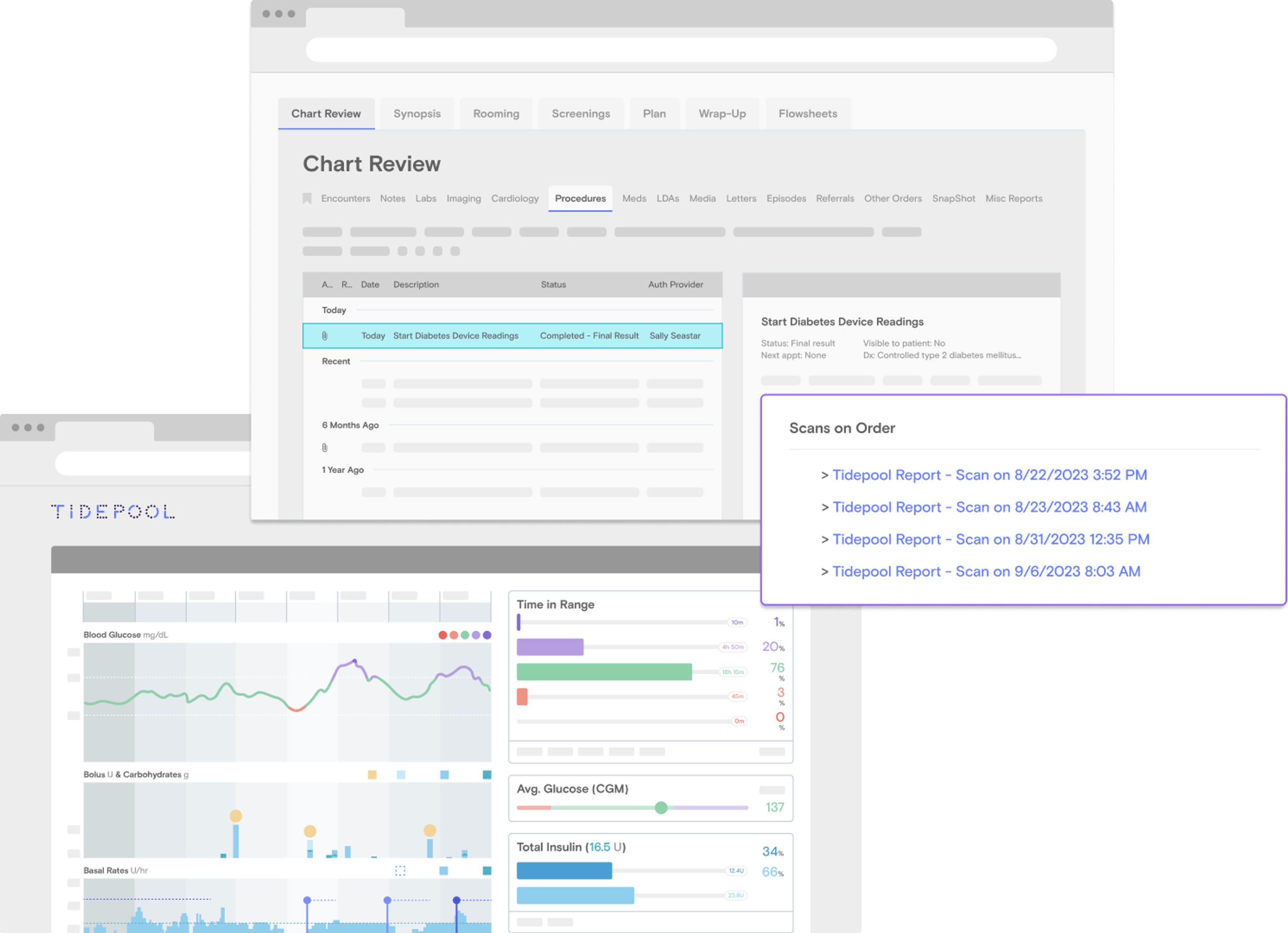

The digital age has ushered in a new era of financial management tools. From budgeting apps to investment platforms, technology is at the forefront of personal finance. These tools not only simplify the process but also empower users to take control of their financial destiny. Staying abreast of emerging trends is not just about keeping up; it's about leveraging these advancements to one's advantage.

Financial literacy is the bedrock upon which sound financial decisions are made. Simplifying complex financial concepts and staying informed about industry news and trends are not just beneficial; they're necessary. As the market ebbs and flows, the informed consumer can navigate the currents with confidence.

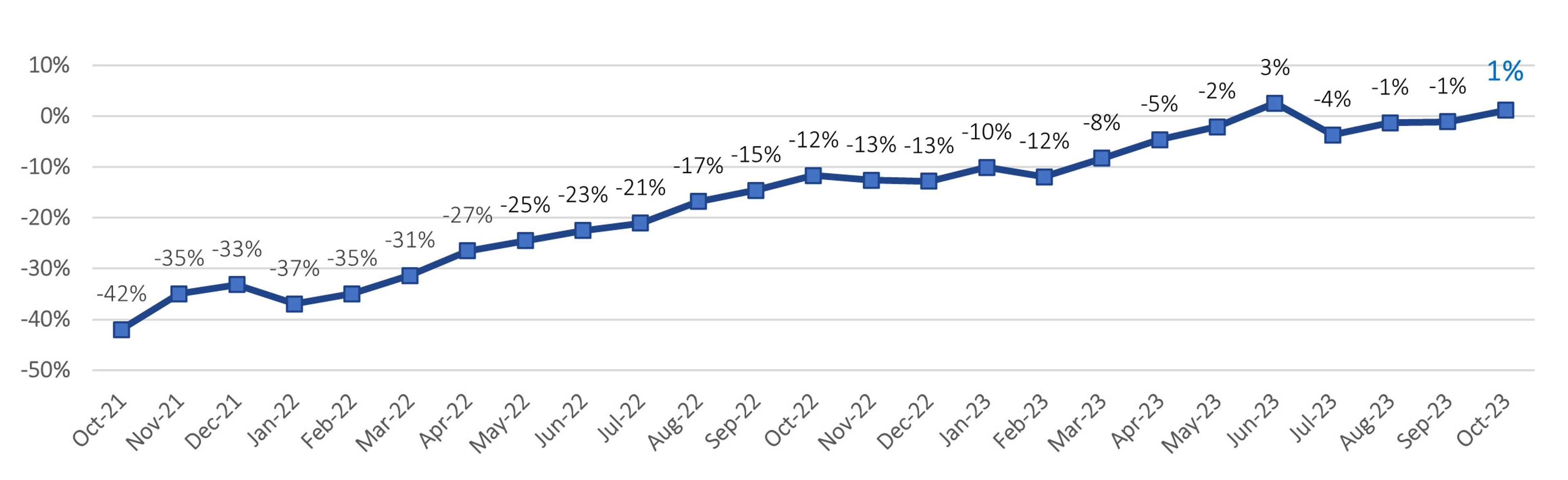

As we conclude, let's recap the importance of proactive financial management. The tools and education available today can be powerful allies in the face of economic uncertainty. It's about adaptability, resilience, and the willingness to embrace change. As Anthony Mancuso, Director, Risk Solutions Consulting, aptly puts it, "2023 won’t be the year of chaos. In fact, 2023 will mark the return of some degree of predictability." He reminds us that the economic impacts of the pandemic were to be expected and that "Robust scenario analysis, near real-time monitoring, and general organizational agility will rule the day."

Martin Zorn, Managing Director of Risk Research and Quantitative Solutions, echoes this sentiment, highlighting the need for financial institutions to adapt: "As changing relationships across risk factors expose the limits and weaknesses of legacy risk management systems, financial institutions will turn to APIs and other tools to patch or replace weak links as they are found."

And in the realm of cryptocurrency, despite its challenges, Dan Barta, Principal Enterprise Fraud and Financial Crimes Consultant, offers a measured perspective: "While recent events will certainly drive increased regulatory scrutiny, cryptocurrency is not dead." He points out that "law enforcement and regulators will better hone their ability to understand the movement and exchange of illicit funds."

In the end, the journey to financial stability is both personal and universal. It's a path paved with challenges, but also with opportunities for those willing to seek them out. The 2023 guide to smart personal finance is not just a set of strategies; it's a call to action for anyone looking to navigate the uncertain waters of today's economy.